Maui Real Property Tax Rate 2025 – 2026

Shifting Priorities in Maui's Property Tax Landscape

September 13, 2025

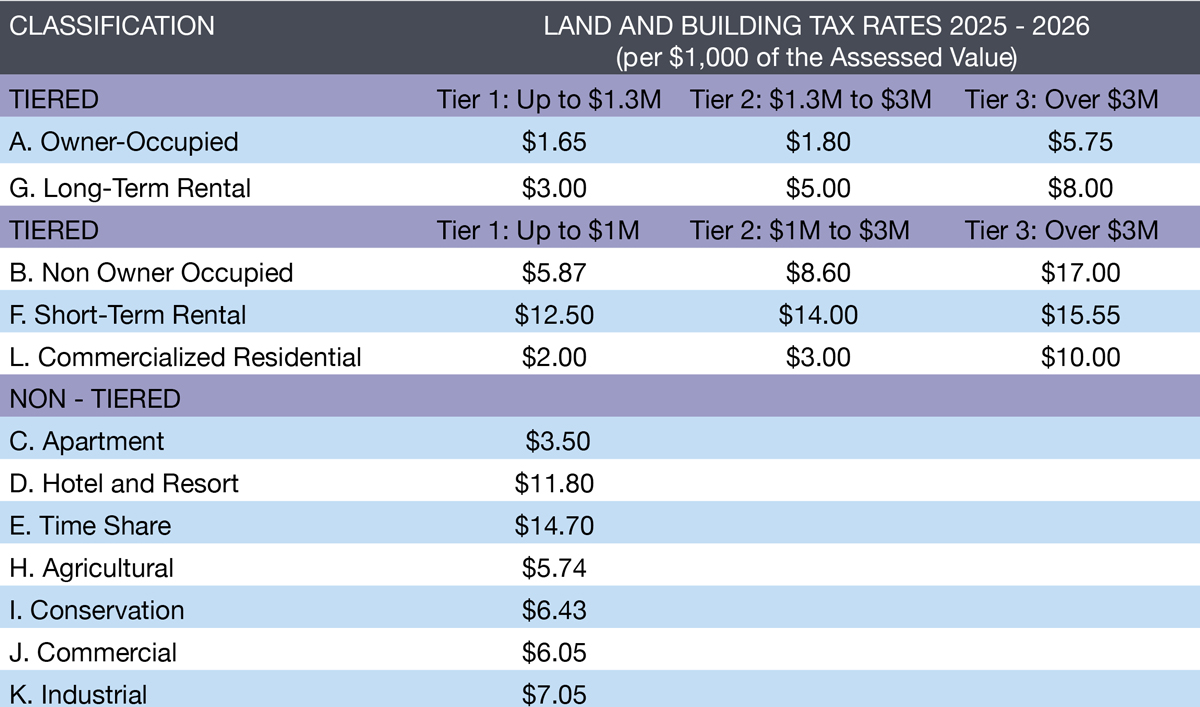

Maui County’s property tax adjustments for the fiscal year beginning July 1, 2025, mark a clear shift in how the county balances revenue needs with housing policy. Compared to the prior period, the new rates reflect both relief for local homeowners and increases on luxury properties and non-resident owners.

For owner-occupied residences, the county lowered the rates in the lower tiers and expanded the value thresholds. A home assessed at under $1.3 million now falls into Tier 1 at $1.65 per $1,000, down from $1.80 under the previous structure. Similarly, Tier 2 dropped from $2.00 to $1.80, with eligibility widened up to $4.5 million. These moves ease the burden for many local families whose homes have appreciated dramatically in recent years. Yet, for the wealthiest segment, the picture is different: Tier 3 owner-occupied rates surged from $3.25 to $5.75, signaling a deliberate effort to shift more responsibility to high-value properties.

The changes are even more pronounced in the non-owner-occupied category, which encompasses second homes and investment properties. While Tier 1 remains flat at $5.87, the middle tier crept up to $8.60, and Tier 3 jumped sharply from $14.00 to $17.00. This reflects a broader county strategy to capture greater revenue from outside investors and luxury property owners, many of whom benefit from Maui’s desirability without contributing directly to its housing supply.

For short-term rentals, rates in the lower tiers remain steady or rise modestly, while Tier 3 edges upward to $15.55. In contrast, long-term rentals saw slight reductions in the lowest tier and unchanged middle-tier rates, a policy nudge encouraging landlords to favor stable, resident-serving leases rather than nightly rentals. Commercialized residential properties, a hybrid use often linked to bed-and-breakfast or partial rental arrangements, were restructured more dramatically, with sharp reductions in lower tiers but a jump in the top bracket.

Overall, the new structure underscores Maui County’s attempt to thread a difficult needle. On one hand, it softens the blow for resident homeowners facing escalating assessments, offering tangible relief in the most common value ranges. On the other hand, it extracts higher taxes from luxury estates, non-resident investments, and high-end rentals, aligning with political and social pressure to rebalance the island’s housing ecosystem. Yet even with rate reductions in some categories, the rapid rise in assessed values—often 40 to 50 percent in just a few years—means that many property owners will still see larger tax bills. The result is a property tax system increasingly used not just for revenue, but as a tool of social policy in a community where the tension between local residents and outside ownership grows ever more acute.

More Maui Real Estate News

MARY ANNE FITCH

REALTOR® · RB-15747 · SENIOR PARTNER

GLOBAL LUXURY SPECIALIST