Maui Real Property Tax Rate 2024 – 2025

Higher taxes on short-term rentals and Luxury Homes

June 20, 2024

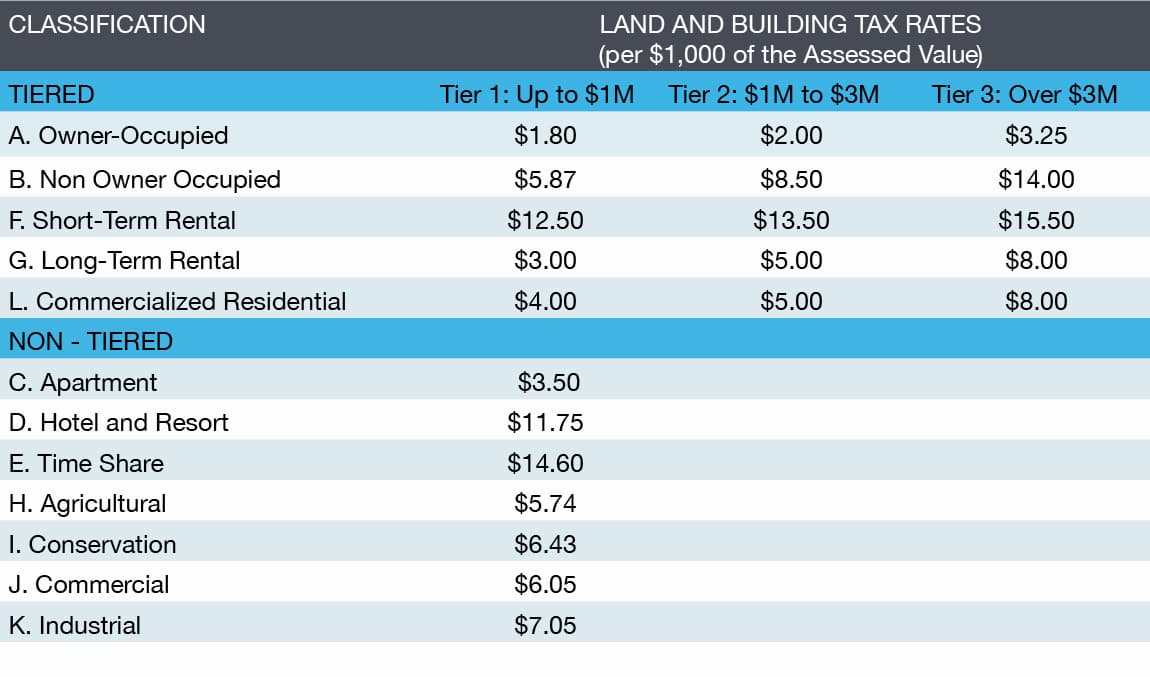

For the most part, the Maui County Property Tax rates remain unchanged compared to 2024. However, owners of luxury homes and short-term vacation owners will see increases. Compared to last year when the Owner Occupied tax rate for Tier 3 saw a 4ct increase from $2.71 to $2.75, the rate will go up 50ct to $3.25. Tier 2 remains unchanged at $2.00 and Tier 1 rate lowered by 10ct to $1.8 per thousand of Assessed Value. The Short-Term Rental tax rate is going up on all tiers from $11.85 to $12.50 for properties assessed under $1M, to $13.50 for properties assessed from $1M to $3M, and to $15.50 for properties assessed above $3M. Second homeowners, whose properties are assessed at $3M and up, will see an increase of $1.50 to $14.00.

The estimated revenue from the Real Property Assessment Division is $587,253,467 for 2024 – 2025, a 9.84% increase compared to last year.

Mayor Richard Bissen is looking to address the long-term housing crisis, exacerbated by the Lahaina fire. He expects short-term owners to switch to long-term to benefit from a more favorable tax rate. His bill to force the conversion of apartment-zoned developments from short-term to long-term is now on pause as the County Council’s Housing and Land Use Committee mandated a study on its economic impact.

In 2021, a similar proposal was introduced by council member Tamara Paltin, who represents West Maui, to phase out transient accommodations in apartment districts. Economist Paul Brewbacker released a white paper, revised in November 2022, to address the potential economic impact. He concluded that the “hypothetical economic impacts” to Maui County would be the loss of 14,126 jobs, and annual reductions of $1.67 billion in tourism money, $747.7 million in employee earnings, and $137.6 million in tax revenue.

More Maui Real Estate News

MARY ANNE FITCH

REALTOR® · RB-15747 · SENIOR PARTNER

GLOBAL LUXURY SPECIALIST