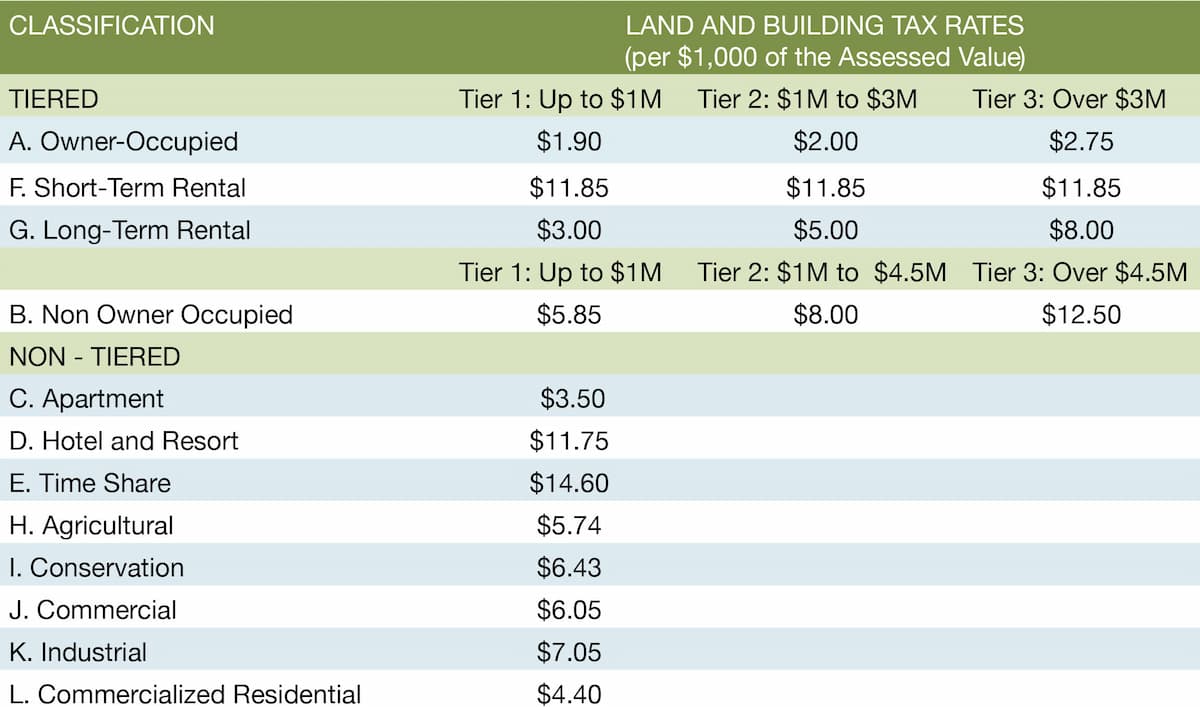

Maui Real Property Tax Rate 2023 – 2024

Mayor Bissen waived property tax for improved properties destroyed in 2023 fires.

February 29, 2024

For the most part, the Maui County Property Tax rate remain unchanged compared to 2023. While Owner Occupied tax rate for Tier 3 saw a 4ct increase from $2.71 to $2, Tier 1 and Tier 2 rate lowered by 10ct to $1.9 and $2.00 per thousand of Assessed Value respectively.

The estimated revenue from the Real Property Assessment Division is $534,623,682 for 2024.

Last year, Mayor Richard Bissen announced that fiscal year 2023-24 property taxes will be waived for improved properties completely destroyed by the Maui Wildfire Disaster in Upcountry, Kihei and Lahaina.

Improved properties were not vacant land (prior to the disaster) and have a record on mauipropertytax.com under "Improvement Information" or "Commercial Improvement Information.” The properties have either a residential structure or a commercial structure.

The Department of Finance, which handles property taxes, is compiling a list of improved properties, by address and tax map key, which were completely destroyed by the fires.

If taxes had already been paid, refunds were issued to the payer. In the near future, a process for people not on the initial list for waiver will be announced.

Devastating wildfires broke out around Maui on Aug. 8, 2023.

More Maui Real Estate News

MARY ANNE FITCH

REALTOR® · RB-15747 · SENIOR PARTNER

GLOBAL LUXURY SPECIALIST