MAUI REAL PROPERTY TAX RATE 2022 - 2023

Maui County Council shaves property taxes for owner-occupied homes

July 5, 2022

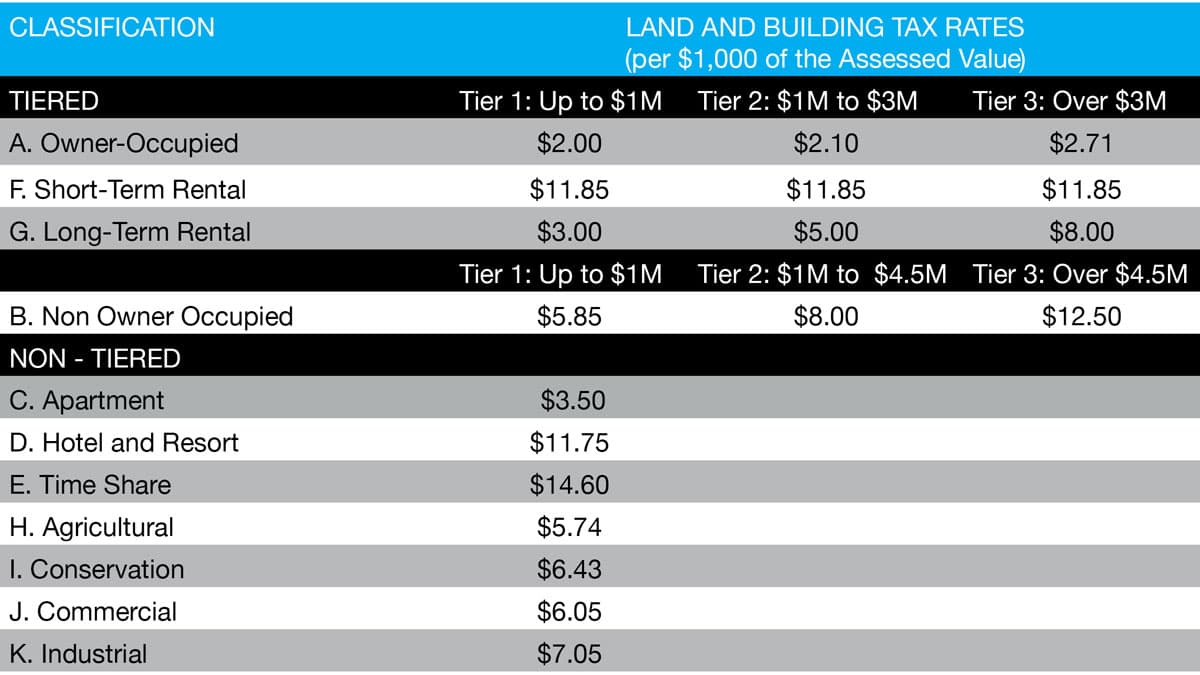

Maui Real Property Tax Rate 2022 - 2023

New rates approved this past May by Maui County Council trim property taxes for most residents who live in their own homes.

Owner-occupied rates of $2.41 at Tier 1 and $2.51 at Tier 2 per $1,000 of net taxable assessed value were shaved to $2 and $2.10, respectively. Owners at the highest Tier 3 remained the same at $2.71.

Council voted 6-0, with members Shane Sinenci, Kelly King and Mike Molina absent and excused, to set real property tax rates for the next fiscal year, which began July 1.

“It really was wonderful that this council is so aligned in its shared goals of providing tax relief to residents this year, and it’s reflected in this real property tax rates,” Council Vice Chairwoman Keani Rawlins-Fernandez, who leads the budget committee, said ahead of the vote.

With the upcoming fiscal year, the classification of Long-Term Rental was added, and rates were set for owners who rent 12 consecutive months or longer. The new grouping is meant to incentivize long-term rentals, which are sorely needed.

Meanwhile, tax rates were increased for non-owner occupied homes. About 70% of purchases in 2020 were non-owner occupied, second homes, according to Hawaiʻi Information Service.

Non-owner-occupied rates of $5.45 for Tier 1, $6.05 for Tier 2 and $8 for Tier 3 per $1,000 of net taxable assessed value shot up to $5.85 for Tier 1, $8 for Tier 2 and $12.50 for Tier 3.

Rates were flat for hotels and resorts, $11.75, along with time shares, $14.60.

For short-term rentals, though, property taxes increased to a uniform rate of $11.85 across all three tiers. Last fiscal year, rates were $11.11 for Tier 1, $11.15 for Tier 2 and $11.20 for Tier 3.

While council members supported the measure, some noted that tax policy and goals should be hammered out when the council is not up against hard deadlines during budget deliberations.

More Maui Real Estate News

MARY ANNE FITCH

REALTOR® · RB-15747 · SENIOR PARTNER

GLOBAL LUXURY SPECIALIST